car sales tax in fulton county ga

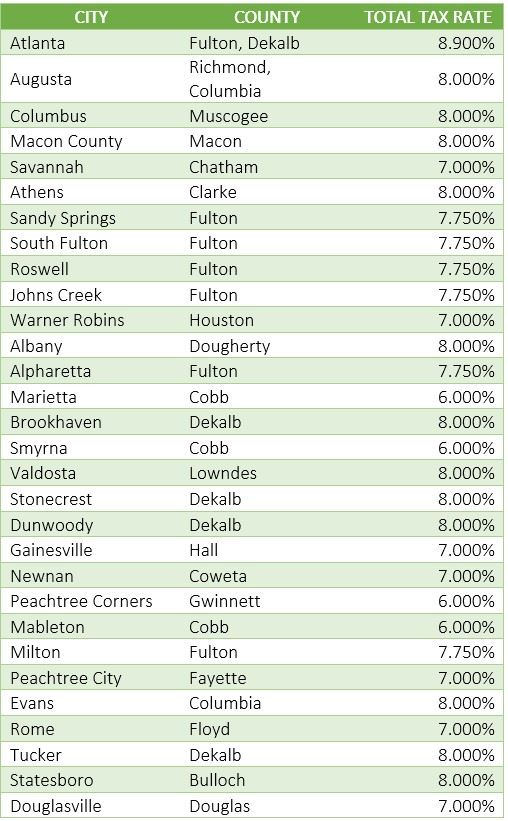

Georgia has a 4 sales tax and Fulton County collects an additional 26 so the minimum sales tax rate in Fulton County is 66 not including any city or special district taxes. The local sales tax rate in fulton county is 3 and the maximum rate including georgia and city sales taxes is 89 as of january 2022.

Property Taxes The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

. This is the total of state and county sales tax rates. Georgia Tax Center Help Individual Income Taxes Register New Business. Sales Use Tax.

Rates Due Dates. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. 2685 Metropolitan Parkway SW Atlanta GA 30315.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. The December 2020 total local sales tax rate was also 7750. Vehicle registrations are handled through the Office of the Fulton County Tax Commissioner.

The owner of the vehicle must. Finance Department Water Billing 404-612-6440. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next.

Tips for Completing the Sales and Use Tax Return on GTC. SW Atlanta GA 30303 404-612-4000 customerservicefultoncountygagov. The Fulton County Tax System will be undergoing system updates from Friday April 22 through Sunday April 24Customers will be able to access general information from the Fulton County Tax Commissioner and Fulton County Tax Assessors websites but may not be able to access individual accounts while updates are underway.

Fulton County Initiatives Fulton County Initiatives. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. TAVT is a one-time tax that is paid at the time the vehicle is titled.

According to CarsDirect Georgia has a state general sales tax rate of 4. Has impacted many state nexus laws and sales tax collection requirements. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner.

Getting a Vehicle Out of Impound read More. You can take the sales tax off the price of your next car repair its tax-exempt. The Georgia state sales tax rate is currently.

A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. General Rate Chart - Effective July 1 2022 through September 30 2022 2166 KB. Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

Transfer Ownership using the form on the back of the title - Read more about the Sellers Responsibilities. When purchasing a vehicle within the state of Georgia you do not actually pay the 4 percent retail sales tax. The Atlanta sales tax rate is 89 Taxing Jurisdiction Rate Georgia state sales tax 400 Fulton County sales tax 300 Atlanta tax 150 Special tax 040.

You can find these fees further down on the page. Fultons rate inside Atlanta is 3. The Fulton County sales tax rate is.

Kroger 227 Sandy Springs Place Sandy Springs GA. You would also pay any applicable county or city car taxes. You can find more tax rates and allowances for Fulton County and Georgia in the 2022 Georgia Tax Tables.

The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd LOST does not apply. The current total local sales tax rate in Fulton County GA is 7750. The 2018 United States Supreme Court decision in South Dakota v.

The Motor Vehicle Division of the Tax Commissioners Office assists citizens with titling and registering motor vehicle equipment as mandated by law. Sales Use Tax Import Return. There is also a local tax of between 2 and 3.

Fulton County Initiatives Fulton County Initiatives. Fulton County in Georgia has a tax rate of 775 for 2022 this includes the Georgia Sales Tax Rate of 4 and Local Sales Tax Rates in Fulton County totaling 375. GA 30303 404-612-4000 customerservicefultoncountygagov.

In addition to taxes car purchases in Georgia may be subject to other fees like registration title and plate fees. This tax is based on the value of the vehicle. Title Ad Valorem Tax TAVT became effective on March 1 2013.

This should be done within 30 days of cancelling your insurance to avoid penalties and fines. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd LOST and the 1 TSPLOST do not apply. The total sales tax rate in any given location can be broken down into state county city and special district rates.

This table shows the total sales tax rates for all cities and towns in Fulton County. Title Ad Valorem Tax TAVT The current TAVT rate is 66 of the fair market value of the vehicle. Instead residents pay an ad velorum tax at the point of registration and must pay this tax annually for renewal according to CarsDirect.

Filing and Remittance Requirements This is a link to Rule 560-12-1-22 on the Georgia Secretary of States website. Vehicle Impounds Evictions 404-612-4451 160 Pryor Street SW Suite J-102 Atlanta Georgia 30303. To review the rules in Georgia visit our state-by-state guide.

Infrastructure For All. OFfice of the Tax Commissioner. Sales Tax Rates - General.

However this retail sales tax does not apply to cars that are bought in Georgia. Fulton County GA Sales Tax Rate. Cancel your registration - even if you sold or traded your car to a dealer.

Taxes vary based on the cars value. 6 rows The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state. Motor Vehicle Recording Transfer Taxes Sales Use Taxes Fees Excise Taxes SAVE - Citizenship Verification.

Fulton County Vehicle Services. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred. This calculator can estimate the tax due when you buy a vehicle.

Georgia Used Car Sales Tax Fees

Social Studies Dollars And Sense Understanding Local Budgets Center For Civic Innovation

Georgia Sales Tax Guide For Businesses

![]()

Georgia New Car Sales Tax Calculator

Georgia Sales Tax Exemptions Agile Consulting Group

Georgia Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax On Cars And Vehicles In Georgia

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

How To Register For A Sales Tax Permit In Georgia Taxvalet

Georgia Sales Tax Rates And Compliance

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties

Georgia Sales Tax Small Business Guide Truic